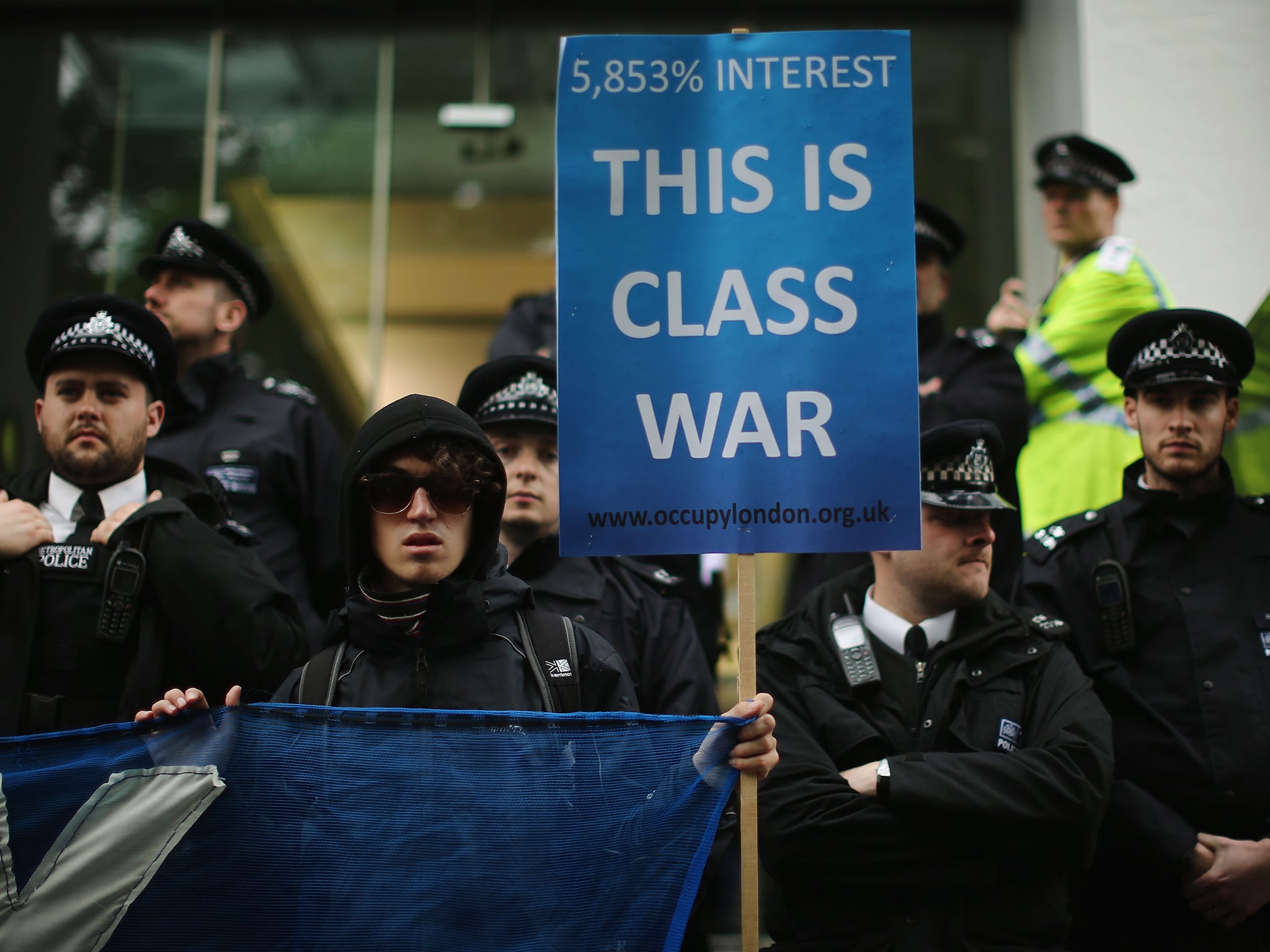

Without financial regulation, payday loan scandals continue to hit the poorest the hardest

Would reform, asks James Moore, have taken as long were the scandal to have impacted on wealthier, noisier consumers, with better access to the media?

It’s the zombie company that’s reached out to torment its victims beyond the grave.

The name wonga.com is cursed by thousands of people that had dealings with a firm that tipped into administration before they had the chance to claim redress.

Their experience suggests that the answer to the question, “is Britain’s financial system failing the poor?” is yes. The same could be said of a related question: “Are financial scandals that affect those with low incomes and little influence handled with the same sort of vigour as those that impact upon middle-class people fortunate enough to have the means to save?”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies