Lisa Markwell: Change your life and stop spending money you don't have

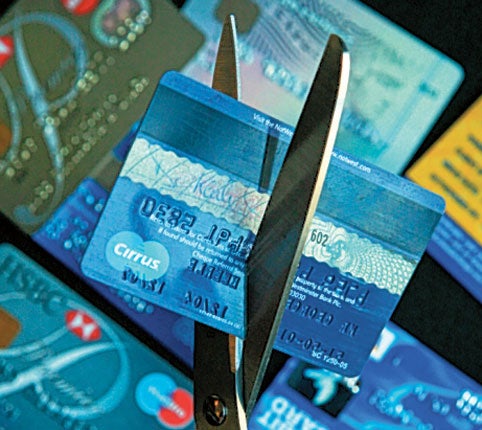

What sound could be sweeter than the dull crunch of a credit card being bisected by the kitchen scissors? It's set to be the soundtrack of the summer, long after the drone of the vuvuzelas has died away, and the grunts of ladies with excess endorphins on centre court are silenced.

We may be the most indebted nation in the world, according to this week's Budget, but slowly, slowly, by saving a little more and borrowing a little less, things are changing. The Bank of England reports that families are keeping more in their pockets than they are spending for the first time in more than two decades.

It's not often I'm proved right about anything, never mind financial advice, but when I stopped using a credit card last autumn, purely to spite the banking bullies, I didn't realise I was an early adopter of a get-debt-down movement. Having lived up to the stereotype of a spendthrift for years, with multiple credit cards – the legacy of always chasing the 0 per cent deals – I came over all parsimonious when the interest rates climbed into the stratosphere. I started paying back, and using my dusty old debit card.

The response of one company (oh all right, it was American Express) was to cut my credit limit right down. I'm no banker, but that suits me very well. But not so much them, I would have thought. Doesn't it work (in their favour) by giving us generous limits that we always bump up against, thereby ensuring years of debt, which is reduced by amounts visible only via an electron microscope?

Well, it turns out, in a Financial Stability Report released yesterday, that lenders are preparing to write off vast swathes of debt because so many of us have done that in recent years. A credit card debt of £4.5bn has disappeared into the ether over the past year; a jaw-dropping amount to us civilians (although, no doubt, managed with their usual dead-eyed efficiency by the financial services industry).

So was it better to reduce my personal debt, or should I have continued buying foreign holidays and fripperies on Net-a-Porter until things got really gritty, then filed for insolvency and indirectly stuck it to the man (to paraphrase the peerless Jack Black in School of Rock)?

Real grown-ups will tell me that the former is better – indeed, having briefly been in close proximity to an undischarged bankrupt I wouldn't want to go there myself – and just living without credit has been a salutary lesson. Perhaps I might feel differently if the weather was dire and the Cornish camp site I'm booked into hadn't upgraded to wooden floors in the tents, but the glow of austerity rivals the sunshine over SW19. How soon one forgets using the credit card in the supermarket, as I did, and I am sure that some of the 147,000 Britons made insolvent last year did, a folly which means that, with the average interest rate approaching 17 per cent, and a cost structure of paying back credit that is almost wilfully (or even definitely) incomprehensible, a tin of baked beans – that symbol of frugal living – could end up costing a hundred quid.

So living within one's means – or in the black – is the new, er, black. No more MasterCard in Marks & Sparks, no more topping up the mortgage to top up the tan in Bali. It feels good; it feels prudent. Of course, with interest rates still climbing (the banks need to recoup that bad debt from the rest of us, natch) and the VAT increase on the horizon, who among us can actually move from borrowing to paying back to – gulp – saving?

Is it just me that is more likely to win Euromillions than have a reservoir of money for a rainy day? Well, against the £20bn that we borrowed, we Brits banked £24bn, so the answer to that is, perhaps, yes...

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies