Voters say they care about inflation more than Gaza. Today’s numbers should worry Biden

Rising rent prices especially remain a huge issue for Americans of every age group

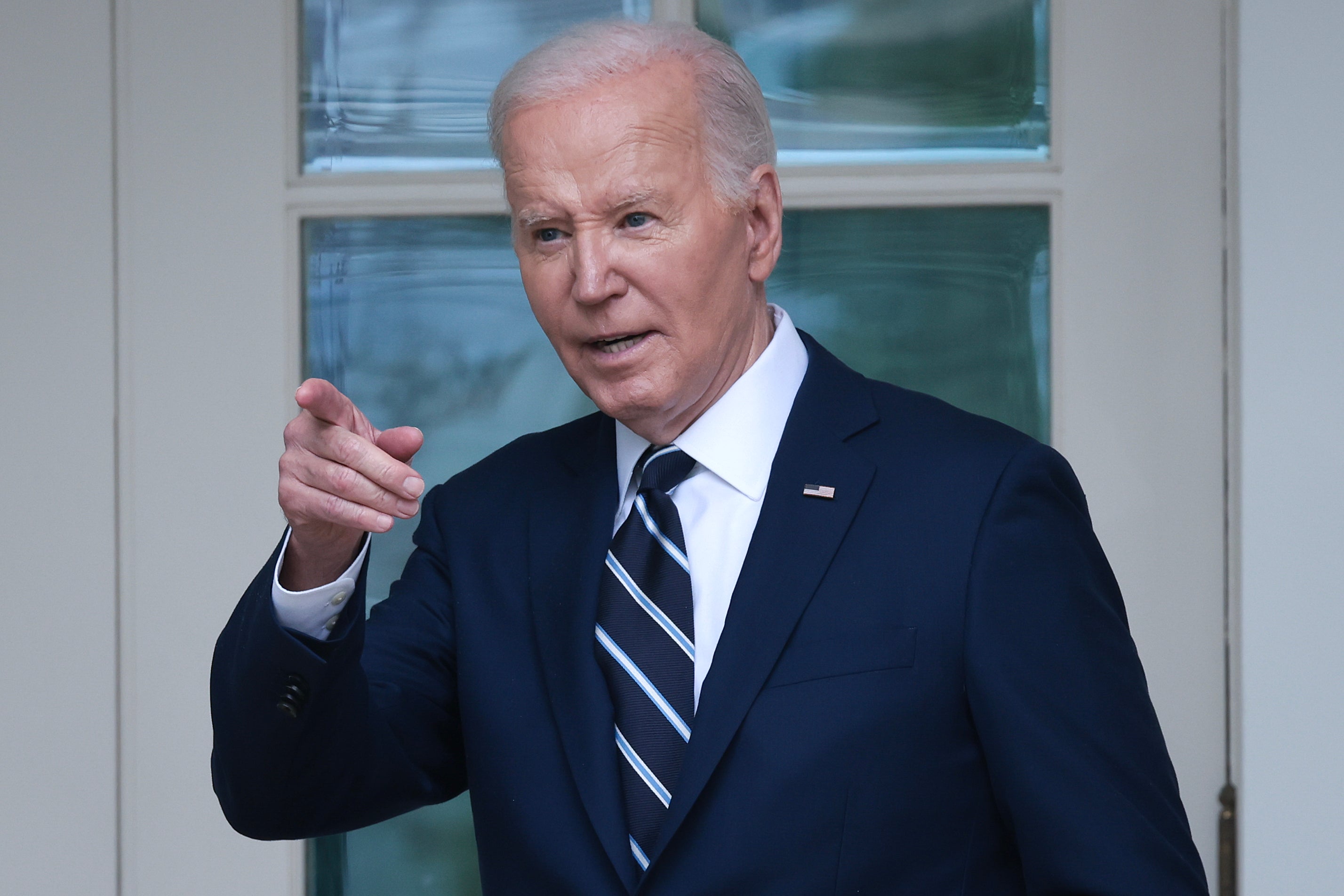

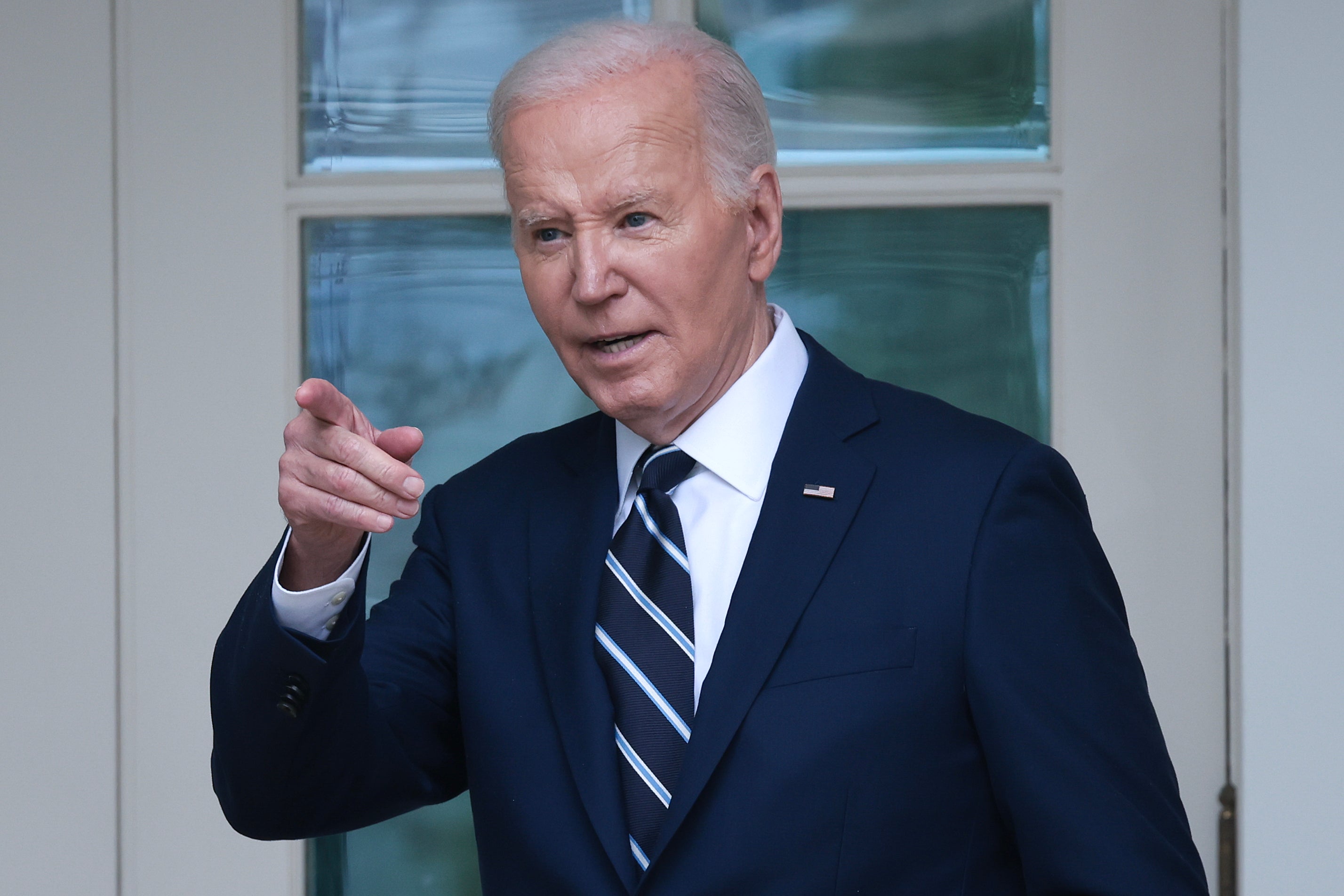

The latest inflation numbers should give President Joe Biden pause.

On Wednesday, the Bureau of Labor Statistics released its latest Consumer Price Index Summary report and found that inflation rose 0.3 points during April and that it jumped 3.4 per cent in the past twelve months.

That number is virtually the same as in March, when inflation increased 0.4 per cent and 3.4 per cent from March 2023 to March 2024.

As usual, gasoline prices and shelter — in other words, mainly cars and rent prices — played the biggest role in price increases. This time, it contributed more than 70 per cent to the increase in prices. Gasoline jumped 2.8 per cent in the past month when in October of last year, it had dropped 4.3 per cent and in March it rose only 1.7 per cent.

Meanwhile, rent and the owner’s equivalent of rent both jumped by 0.4 per cent in the past month. By comparison, food remained virtually unchanged. Food at home — meaning products like groceries — actually dropped by 0.2 per cent.

Inflation has been Biden’s most persistent enemy throughout his presidency. Rising prices have soured Americans on the president, despite a hot labor market where wages are up. Indeed, earlier this month, the BLS’s jobs report found that despite jobs numbers underperforming expectations, the United States has experienced its longest streak of unemployment being below 4 per cent since the late 1960s.

Nevertheless, the latest numbers are a blow to Biden. A New York Times/Siena College poll released this week found that while most Americans consider the economy — namely jobs, and the strength of stock market — their top issue, inflation and the cost of living is also extremely important to them. Indeed, it outpaces Gaza as an issue among every age group.

It may be a surprise to some that inflation motivates plenty of young voters, but the data is clear. Last month, the Harvard Institute of Politics released its poll of voters between the ages of 18 and 29. The survey found that 64 per cent of young voters call inflation a major issue facing the United States, while 56 per cent of young voters list housing as a major issue. Meanwhile, only 50 per cent list women’s reproductive rights as a major issue, 34 per cent of young voters list Israel and Palestine as a major issue and only 26 per cent list student debt as a major issue.

Biden does seem to understand this. He made a statement on Wednesday saying inflation still is on the downswing, noting how core inflation — meaning energy and food — remains on the decline.

“Fighting inflation and lowering costs is my top economic priority,” he said. “I know many families are struggling, and that even though we’ve made progress we have a lot more to do. Inflation has fallen more than 60 per cent from its peak, and core inflation fell to its lowest level in three years.”

The president also cited concerns about housing.

“Prices are still too high — so my agenda will give families breathing room by building two million new homes to lower housing costs, taking on Big Pharma to lower prescription drug prices, and calling on grocery chains making record profits to lower grocery prices for consumers,” he said.

Federal Reserve Chairman Jerome Powell also seemed to acknowledge that housing remained a persistent problem. Speaking at a Foreign Bankers' Association conference in Amsterdam, he cited housing as a serious issue for Americans in 2024. The Federal Reserve has elected so far to not cut interest rates after raising them throughout much the past few years.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments