'Big Short' investor Michael Burry shares quote slamming NFTs as 'magic beans' sold by 'crypto grifters'

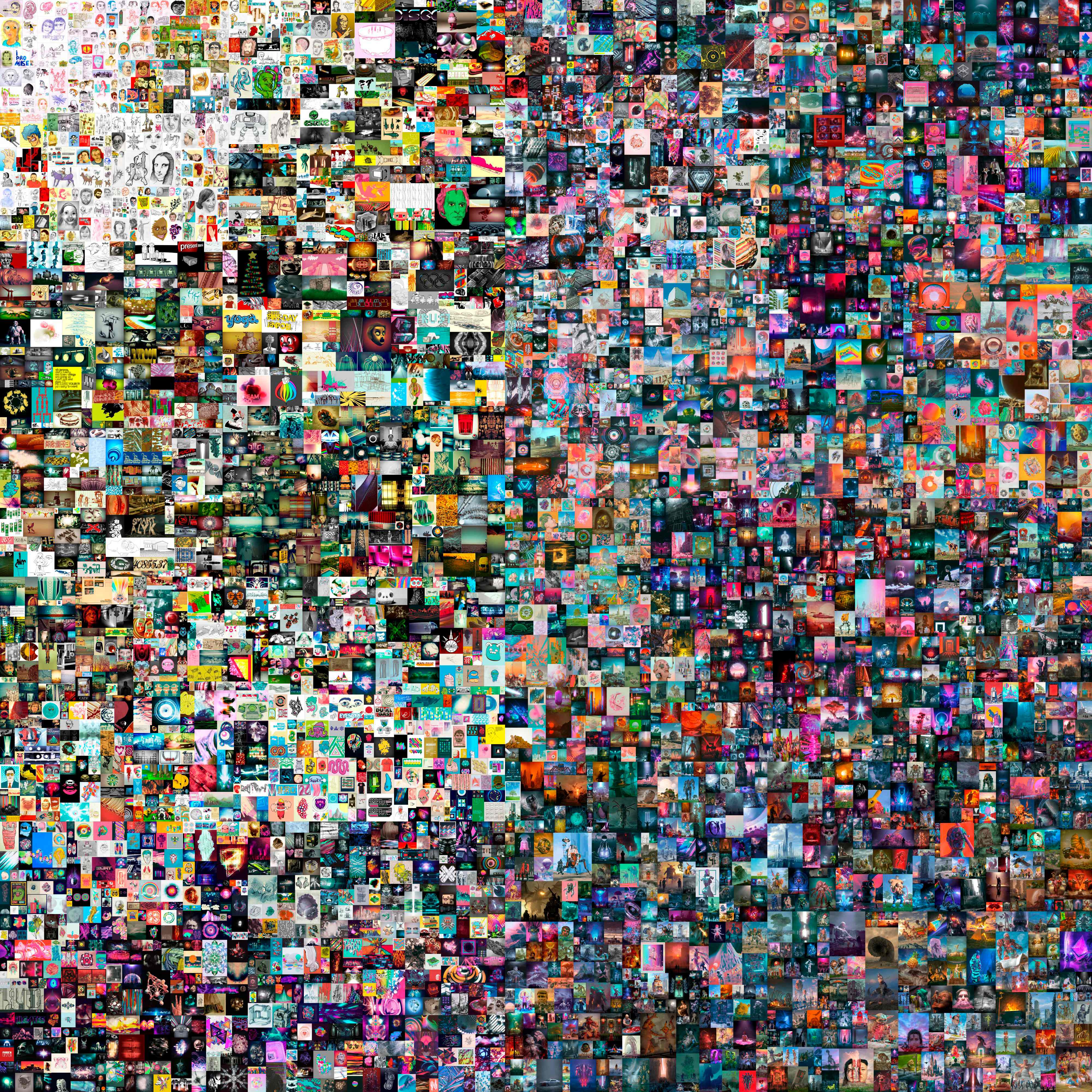

An NFT recently sold for $69m at Christie’s auction

Non-fungible tokens are a boon for a few and confusing to many, but some people - like Michael Burry, an investor featured in "The Big Short" - see them as little more than a con.

Mr Burry, who formerly ran Scion Capital and who managed to profit by shorting the real estate market in anticipation of its collapse, has turned his attention to the inscrutable world of non-fungible tokens, or NFTs. He does not appear to be a fan.

He recently changed his Twitter banner image to a screenshot of a quote: "NFTs exist so that the crypto grifters can have a new kind of magic bean to sell for actual money, and pretend they're not selling magic beans."

The quote is from an article by David Gerard on his blog, Attack of the 50 Foot Blockchain, which was posted last week.

Mr Gerard is the author of a book that shares the name of his blog that critically examines bitcoin and other cryptocurrency-related topics.

Speaker to Markets Insider, Mr Gerard doubled down on his words, saying the description was an accurate summation of the market.

"The crypto world has always been about creating a new kind of worthless magic bean to sell for actual money - first bitcoins, then altcoins, then ICO tokens, then DeFi, now NFTs," he said.

Mr Gerard said he understood that subjective value is determined solely by what someone is willing to pay for an item, but he said it was also fair to point out the utter lack of intrinsic value the "magic beans" possess.

"You could say something is worth what someone will pay for it; but it's also fair to state that the intrinsic value of these things is zero," he said. "And you can definitely get rich with them, but you're much more likely to lose your shirt."

NFTs re-emerged into the broader public consciousness last week after one was sold for $69m at Christie's auction.

An NFT - which often takes the form of an image or GIF - is a proof of ownership of some digital item. The NFTs are stored on blockchain.

Unlike money - which is fungible, meaning its units can be traded and exchanged for equal value, like four quarters equaling a dollar - NFTs are supposed to be one-of-a-kind assets. However, unlike non-fungible assets in the material world - like original paintings - NFTs do not have a tangible form. They are purely digital.

In theory, owning an NFT means one would own the "original" version of a digital piece of art. The original Mona Lisa is far more valuable than any reproduction, but only if it can be proven that it is the original Mona Lisa. In the same way, NFTs allow for collectors to prove to others that the digital art they own is the "original."

"It’s like a 'Certificate of Authenticity' that’s in Comic Sans, and misspelt," Mr Gerard wrote in his blog.

Just like with the Mona Lisa, however, there is nothing stopping people from reproducing the digital art tied to the NFTs. In some cases, artists who create a work and sell off its ownership rights via NFT still keep copyright ownership, allowing them to continue producing the same piece of art.

Tesla CEO Elon Musk and his wife and famous singer Grimes have both dabbled in the world of NFTs, as has Twitter CEO Jack Dorsey and Mark Cuban of "Shark Tank."

Mr Gerard believes that the "crypto-grifters" pushing NFTs are trying to swindle artists out of their labour and their creations in an effort to inflate the cryptomarkets.

"NFTs are entirely for the benefit of the crypto grifters. The only purpose the artists serve is as aspiring suckers to pump the concept of crypto — and, of course, to buy cryptocurrency to pay for “minting” NFTs," Mr Gerard wrote. "Sometimes the artist gets some crumbs to keep them pumping the concept of crypto."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies