City tells Virgin to expect tough fight from big banks

Fledgling bank's market share will be small even after buying state-owned lender, analysts warn

Virgin Money faces an uphill struggle to make a meaningful impact on British banking, despite buying Northern Rock for a knockdown £747m and earmarking a possible flotation for as soon as 2014, City analysts warned yesterday.

The deal is the first disposal of any part of the vast tranche of the banking industry taken into state hands during the financial crisis, although the price is £375m short of Northern Rock's net asset value of £1.122bn. The price could increase to £1bn depending on performance.

Sources close to the deal said that while the price, at 0.9 times "book value", represented a loss, it looked better when compared with most of the banking sector, which trades on the stock market at about 0.5 times book value.

Virgin Money's chief executive, Jayne-Anne Ghadia, said: "We feel we paid a very, very full price. From our perspective we have paid £1bn of value with £747m in cash, £150m of additional capital into the business and more dependent on performance.

"It is our ambition to float this business, not because our investors want an exit but to access growth capital at the same price as our competitors. I think this is an important step and gives us an opportunity to grow and a presence on the high street.

"The Virgin brand is attractive to consumers. People are feeling there is not much difference between Royal Bank of Scotland and HSBC or Lloyds and Barclays. We can make a difference."

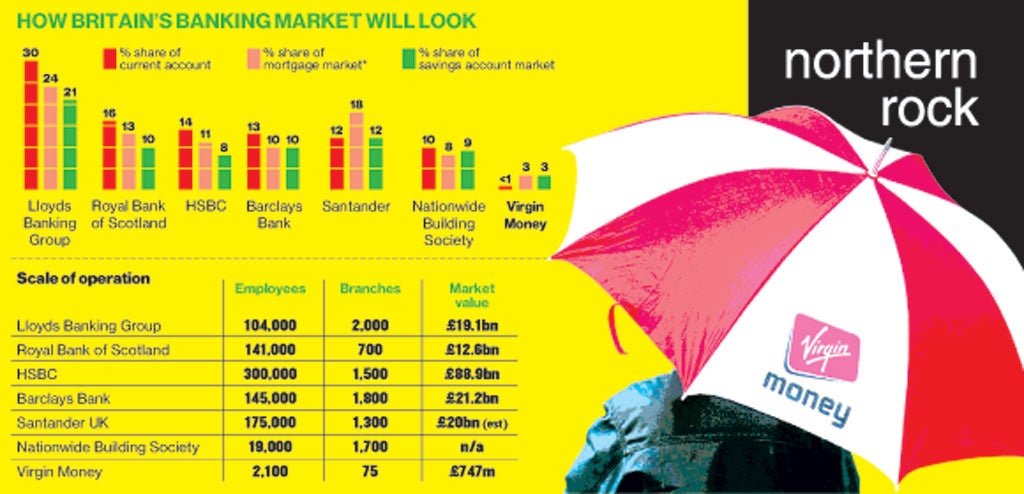

The "bad" part of Northern Rock, now known as Northern Asset Management and containing nearly all of the high-risk loans it advanced before the credit crunch, remains in the taxpayer's hands. Northern Rock's 75 branches will be rebranded as Virgin Money but its operations in Newcastle will be retained. The bank's market share is just 1.5 per cent of savings and 1.2 per cent of mortgages; as such, it barely scrapes into the top 10.

However, a combination with Virgin Money will create an entity with 4 million customers – one million of whom will come from Northern Rock. It will, thereafter, rank as Britain's seventh-biggest lender.

Further firepower will be added if Ms Ghadia can get her hands on the UK credit-card business being sold by Bank of America. Nonetheless, the banking industry is braced for expensive new regulation over the next few years which could constrain Virgin's room for manoeuvre.

City analysts greeted the deal with a shrug yesterday, saying they would not be altering their forecasts for the profits of establishment banks. Nic Clarke, at Charles Stanley, said: "I guess people will concentrate on the price tag but it is an important psychological step. But [Northern Rock] is small and... it will be hard for new players hoping to gain momentum. To really break in and worry the big banks you would need a lot more market share."

His comments were echoed by a source at one major lender, who said: "This is, in fact, an existing bank and, as such, it stands a better chance than a genuinely new entrant like, say, Metro Bank. Competition generally is quite a good thing but we're not too worried."

Who's in charge: Virgin's bosses

Jayne-Anne Gadhia

Often described as the first lady of UK banking, Virgin Money's CEO Jayne-Anne Ghadia trained as an accountant with Ernst & Young before moving to Norwich Union, where she was involved in deals that created Virgin Money. She also had a spell at Royal Bank of Scotland.

Sir David Clementi

Like Ms Gadhia, Virgin Money's chairman is an accountant. Unlike her, he has had conventional career in finance since graduating from Oxford, eventually moving to the Bank of England as a deputy governor. He has also become a serial non-executive director.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments