Hamish McRae: In the long-suffering eurozone the politics must give way to the economics

Economic Life: We - and the various other national lenders - will be putting in the money because no one else is prepared to do so, and so there is a risk involved

Currency and insolvency crises have a curious inevitability to them. The numbers, be they those of a company or a country, deteriorate. The management or the government asserts that everything is fine and the assessment of the financial markets, the banks, the rating agencies, whatever, are all wrong. "Speculators" are cast as particular villains. Then things gradually get worse until, often quite suddenly, the game is over. The country is bailed out, the company goes into administration – and the previous people in charge are booted out.

Sometimes, to be sure, the sequence is slightly different. In the case of the UK, the old team was booted out before the crisis came to a head, leaving the new lot to pick up the pieces and in this case avoid humiliation. In the case of Ireland, the deal was done by the old management and then the new ones tried to unpick it. And in Portugal, the management was kicked out but the country hit the buffers before the new ones could be installed. But in every case the politics gave way to the economics. The harsh mathematics that you have to pay debts as they fall due overrides everything.

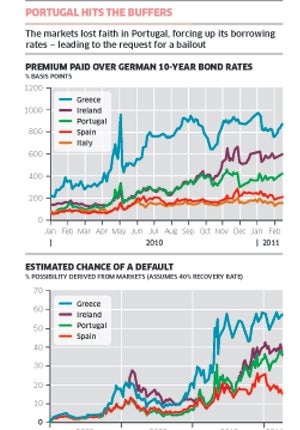

You can see how the markets came to the conclusion that these three countries could not meet their obligations from the two main charts. The first shows the gap between the amount they (plus Spain and Italy) would have to pay for new 10-year debt over and above what the eurozone's most creditworthy borrower, Germany, has to pay. It is shown in what are known as basis points, where 100 points equals one percentage point. So Greece currently has to pay nearly 10 per cent more than Germany, whereas at the beginning of last year it only had to pay 2 per cent more. The premium varies with the news flow. Thus a year ago Ireland was able to borrow at less than 1 per cent more than Italy and less than 2 per cent more than Germany. You can see why, mistakenly, the Irish government thought it could get through. But confidence is a fragile thing and a situation that looked under control suddenly wasn't any more. And so it has proved with Portugal.

The other graph makes a similar point in a slightly different way. It looks at the probability of a country defaulting on its debts at any time during the next five years, derived from the cost of insuring the debt against such a default. For Greece, it is worse than evens: there is more than a 50 per cent chance of the country defaulting. For Ireland and Portugal, the unflattering truth is that investors think they have a 40 per cent chance of defaulting. For Spain, it is less than a 20 per cent chance, and as you can see, investors have become more optimistic in recent weeks, not less, that Spain can make it through. But of course that could change. Put it this way: investors are at the moment attributing the same risk level to Spain as they did to Ireland back in the middle of 2009, and we know what happened then.

The detail of what will happen in Portugal remains hazy but some sort of bailout will take place that will enable it to finance itself for the next couple of years. I don't think it matters very much what the terms are for a temporary loan until the country get its new government, and we know that the eventual bailout will broadly follow the terms available to Greece and Ireland. Portugal will be able to borrow medium-term funds at around 6 per cent.

What are the implications? The important thing to make clear is that the country, like Ireland and Greece, is getting a loan, not a grant. There has been a lot of stuff around that this will cost Britain £4bn or something like that. It won't. We will be lending money that we will earn interest on and will hope to be repaid. We – and the various other national lenders – will be putting in the money because no one else is prepared to do so, and there is therefore a risk involved. But even in a worst-case scenario we will get paid something, let's say 60 cents in the euro, and we will have earned some interest in the meantime.

But if this is a loan and not a grant, and no one in the commercial world is prepared to lend the money, is it realistic to expect to be repaid in full? This is, of course, a question of judgement, and for what it is worth my own feeling is that Greece will indeed default because the debts are simply too big to be serviced, let alone repaid. Ireland I think will scramble through and be able to repay in full, thanks to the strength of its export sector and the real competitive advantages it has of its skilled, English-speaking workforce within the eurozone. And Portugal? Well, I am afraid I don't like the numbers at all – nor indeed the numbers for Spain either.

You can see the comparison with Spain in the panel. Portugal has a slightly lower annual fiscal deficit (and lower, ahem, than that of the UK) but a much higher stock of debt – debt that will exceed 100 per cent of GDP in the next couple of years. It has lower unemployment than Spain, for that 20 per cent plus level in Spain is a catastrophe. But it has a problem of its general competitiveness, as exemplified by the huge current account deficit. In the past both countries would have devalued to try to improve their competitive position, but they can't because they adopted the euro.

This leads into the greatest question of all: would a default by a eurozone country lead to it leaving the eurozone itself?

In theory the answer is no, but in practice the answer would almost certainly be, eventually, yes. A default by Greece or Portugal would not undermine the creditworthiness of Germany. The fact that Portugal is in a mess now does not mean that Germany is in a mess, rather the reverse. But a series of defaults might start to damage the euro, just as a default by a US state or large municipality would undermine the dollar. In any case, even after default, the country would still be uncompetitive, for the underlying economic conditions that led to the default would still be there. It is conceivable that German taxpayers would be prepared to make some payments to the exchequer of the defaulting government, but I find it hard to see them wanting to put in much over and above what has been lost of the loans.

The important thing to appreciate, though, is that all this is some way off. We are going to see several years of a messy scramble. The strong parts of the eurozone will be fine. Germany had some more very good data yesterday. And the euro itself looks quite attractive vis-à-vis the dollar and sterling. That rise in interest rates yesterday demonstrates that the European Central Bank is serious about inflation in a way that we are not.

Meanwhile, the agony for the zone's weaker members continues.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies