Hamish McRae: Central banks should slowly start to get back to normal monetary conditions later this year

Economic View: The balance of advantage and disadvantage has shifted and will continue to shift

Five years of an ultra-loose monetary policy and where are we? Well, we have got the economy moving, for it now seems to be growing above trend, probably around 3 per cent a year. We have turned round the housing market, now past its previous peak in much of the country and moving up even in the lagging areas. Employment growth has been stunning, with the private sector adding nearly 250,000 jobs a quarter. And consumer inflation, while troublingly high for several years, has at last come down to below 2 per cent, the centre point of the target range.

Put all that together and it does not sound too bad. But there have inevitably been costs and the longer the policy has been pursued the more apparent these have become. The balance of advantage and disadvantage has shifted and will continue to shift.

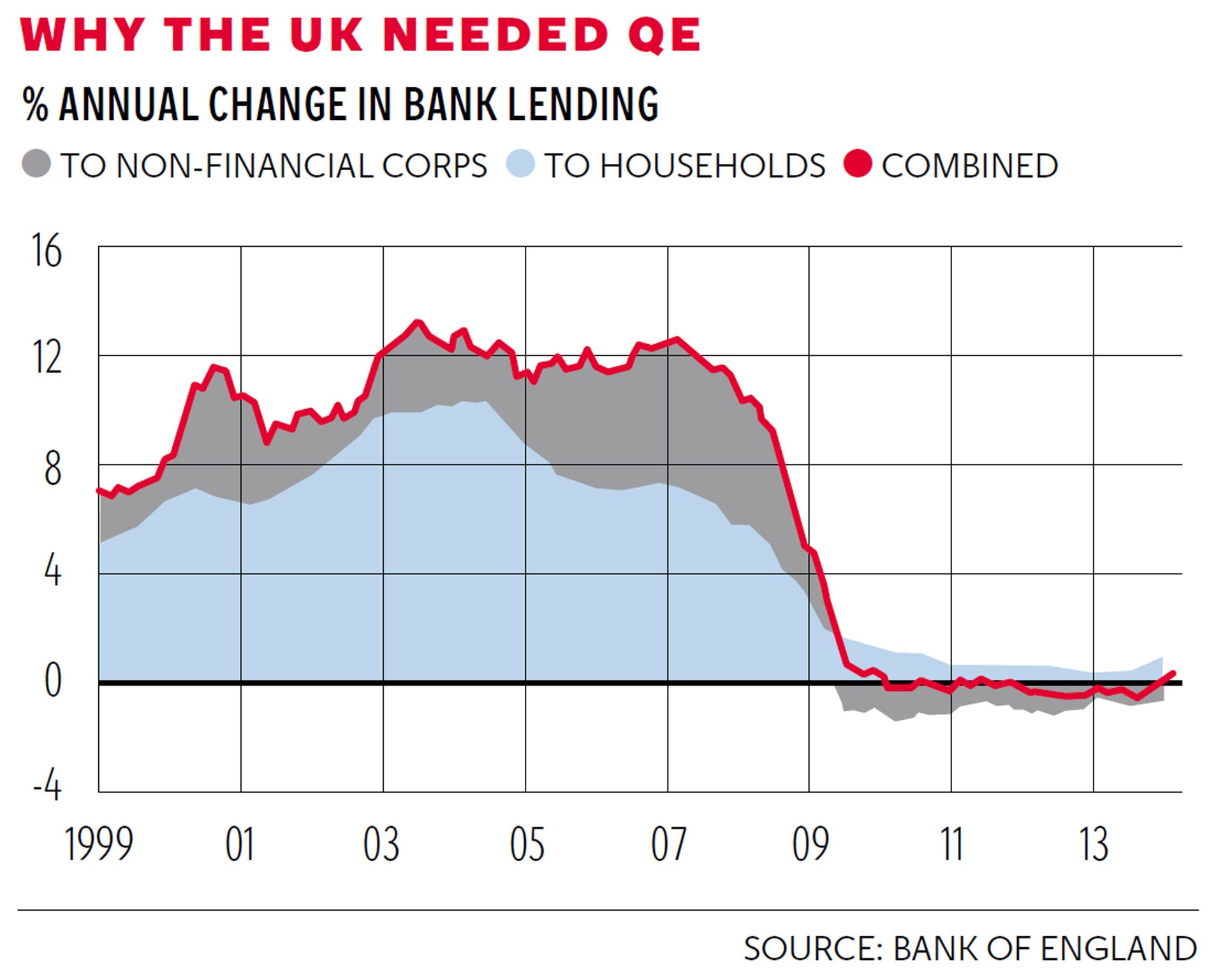

To see why something had to be done, look at the graph. It shows the annual increases bank lending in the boom years and what has happened since then. As you can see, things went mad. Banks sprayed loans around both to businesses and individuals. In the run up to the crash bank lending was going up by some 12 per cent a year. Take growth at 3 per cent and inflation at 2 per cent and you get a figure of 5 per cent as the sort of annual increases that you might expect. The excess was froth – a level of lending that was at best brave and at worst grossly irresponsible. We are still paying the price for that now.

But since then the reverse has happened. We have had to try to grow an economy with banks that are unable to increase their lending. Indeed, lending to companies has been negative and continues to be so, while lending to households has been only just positive, though it has picked up a little in recent months.

You can have a separate debate as to why the banks have not been lending: excessive capital requirements, over-bearing regulation, a lack of demand for loans, or simply a burst of caution among bank employees. The point is simply that in this climate central banks here and in the US (and in a rather different way in Europe) had to flood the markets with money and hope that one way or another this money would boost demand. It did, but mainly by boosting asset prices.

So house prices here and in the US have recovered. Shares in the US are at an all-time high, and are pretty close here. Housing and share prices in the strongest of the eurozone economies, notably Germany, have been strong too. Current inflation, by contrast (and rather counter to the expectations five years ago) has been quite weak, and may be getting weaker now.

The recovery in asset prices may be broadly welcome. At household level it extracts people from negative equity on their homes and at a commercial level it boosts confidence. It is fascinating to see how companies here in the UK are at last starting to demonstrate that confidence by increasing investment. But it hands profits to those that have assets, not to those who don't. So it is a policy that increases inequality.

It gets worse. It is a policy that punishes unsophisticated savers and rewards sophisticated ones. People who have kept their money in a bank have had the real value of their savings cut by more than 10 per cent over the past five years. People who have bought shares will have increased the real value of their savings by up to, gosh, 50 per cent – though they may have lost quite a lot in the couple of years before.

The social consequences take some time to become apparent. Gradually people adjust their habits. Instead of keeping money in a bank people find other investments, which may or may not be safe. The awkward word to describe this process where we use banks less and less and find other ways of linking borrowers and savers is "disintermediation". We no longer use the intermediary of a bank to hold their spare cash but instead use financial market instruments, peer-to-peer lending, even for many more fortunate young people, the bank of mum and dad.

Not all of this is bad. Arguably banks had become too big relative to the financial system as a whole. But banks are convenient and so we are having to learn how to develop what will inevitably be a more cumbersome financial system. You could say that we need all this money washing around precisely because we have to get along with more cumbersome ways of linking people who have money with people who want or need to borrow it.

The huge question then is how quickly should the central banks try to get back to normal monetary conditions: not just the end of QE but gradual and progressive over-funding of government borrowing needs so that the stock held by the central banks is run down. The short answer is: slowly. Everyone agrees on that. What people cannot agree on is whether it is safer to start getting back to normal soon, say this year, or whether it would be safer to delay until growth is more embedded.

The danger of the first is obvious: you clobber the economy before it is ready to stand it. The danger of the second is less obvious but just as troubling: that once you do start to move you have to bang rates up even faster and choke it off mid-cycle. Indeed, if you delay increasing short-term rates you may find the bond markets take matters into their own hands and push up long-term rates for you.

There is no easy answer to any of this. My own instinct is that it would probably be safer to make a start on getting back to normal later this year, partly to make it clear to everyone that the costs are beginning to outweigh the benefits, but also to get people prepared for a slow and gradual tramp to normality. That is my "forward guidance" anyway.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies