Lib Dems' fix for the housing crisis: bank of mum and dad

Pensions warning as Clegg unveils plan to fund children's deposits with retirement savings

Young people looking to get their first step on the property ladder may already look to their parents for financial help, but under the Liberal Democrat scheme outlined yesterday they will now have eyes on their pension pots.

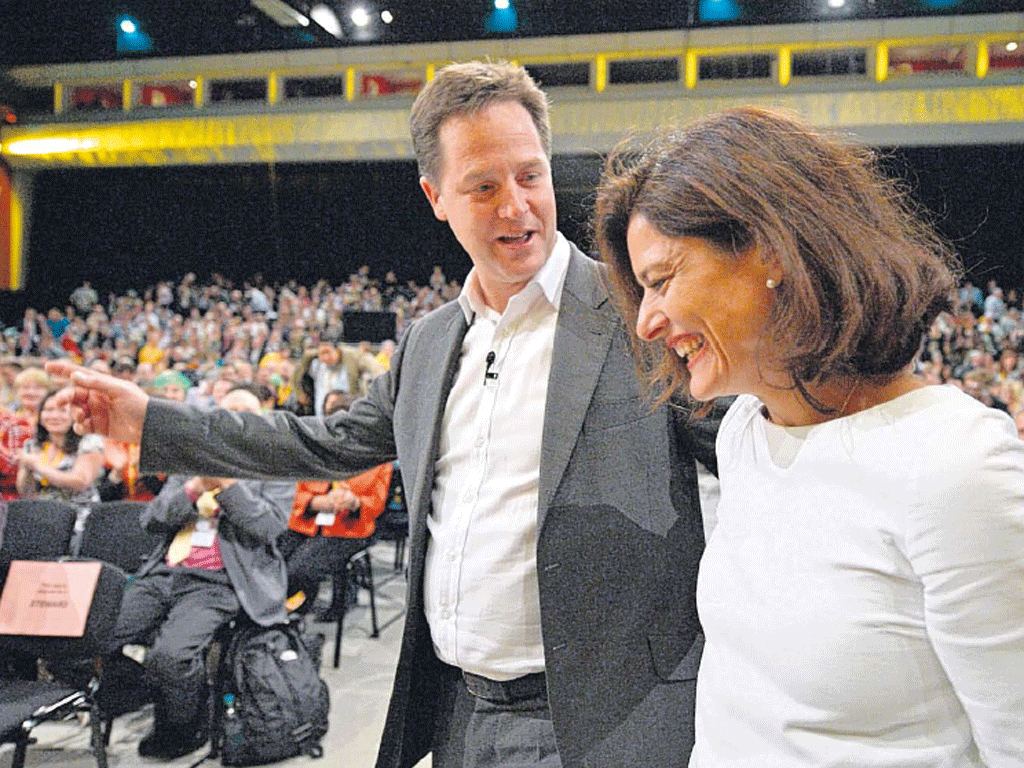

The scheme announced by the party's leader, Nick Clegg, will allow parents and grandparents to put forward their savings tied up in pension funds and offset them against the cost of a deposit for their children to buy a property.

Party sources said they estimated that up to 250,000 families would be eligible to take advantage of the "pensions for property" scheme – securing deposits of around £10,000 each.

"We realise that this is not going to be the right scheme for everybody – but that doesn't mean we shouldn't make the option available," said one source. "It is about pushing innovative ideas to help young people get on the housing ladder."

However banking and pension industry sources were markedly less enthusiastic. One described the plan as potentially "Maxwellesque" and fraught with difficulties while the Association of British Insurers said they would need to examine the details carefully before endorsing it.

"Pensions are designed to mature into a decent retirement income, not for other purposes," said Otto Thoresen, director general of the organisation. "Any scheme which uses pensions as a guarantee must ensure that it does not inadvertently make the saver worse off when they retire."

Announcing the scheme Mr Clegg said it was designed to open up another source of funds for first-time buyers. "We have thousands of young people who are desperate to get their feet on the first rung of the property ladder but deposits have doubled and the number of young people asking for help from family members has doubled," he said.

"[We are] going to do something that hasn't happened before: we are going to work out ways in which parents and grandparents who want to help their children and grandchildren buy a property of their own, we are going to allow those parents and grandparents to act as a guarantee if you like so their youngsters … can take out a deposit and buy a home."

Liberal Democrat sources said of the 250,000 people who had a pension pot of more £40,000, around 5 per cent were likely to take advantage of the scheme, meaning 12,500 people could benefit. They said it was so far not clear if legislation would be required but they were confident the scheme would be in operation by 2015.

Danny Alexander, Chief Secretary to the Treasury, added: "There are an awful lot of parents out there who don't have any cash to help their children get on the housing ladder. But in many cases they will have built up a substantial pension pot.

"That is their only asset which they will able to, when they reach retirement age, release a tax free lump sum.What we want to do is for parents in that category [to be able to] use that lump sum, which they will get when they reach retirement age, to guarantee part of the mortgage, the deposit on that mortgage, precisely to help their kids or grandkids to get on the housing ladder. It is about inter-generational fairness."

Mr Clegg admitted that he had been unable to persuade the Tories of his party's plans for a mansion tax on the most expensive properties. However he suggested that the Chancellor, George Osborne, was not opposed to any form of "wealth tax".

"I think there is a very considerable chance [of a new wealth tax], because we have already done a lot of it, to make sure that the top pay more tax.A mansion tax is not the only way in which you can make people at the top make a fair contribution."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies