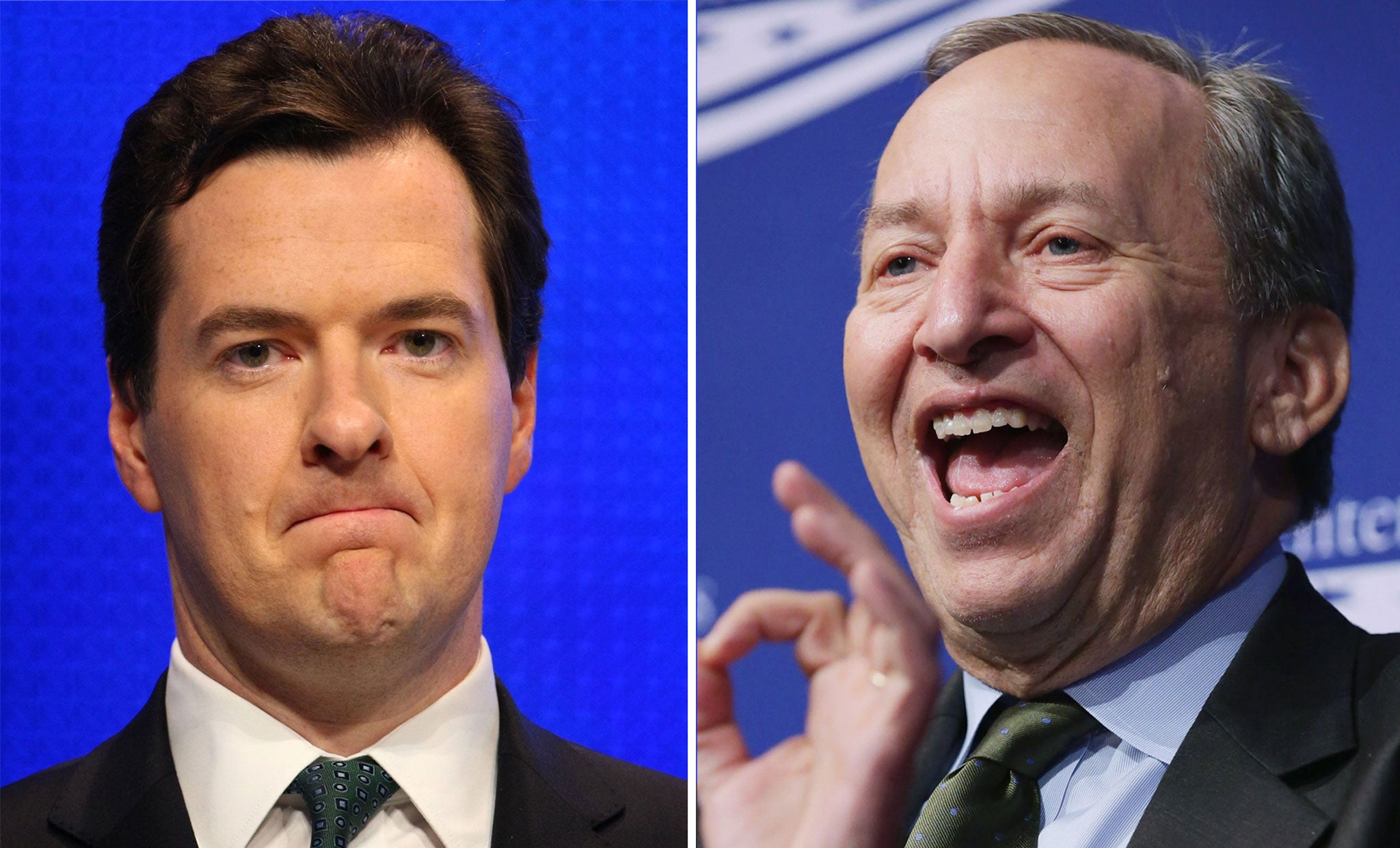

George Osborne clashed with one of his heavyweight critics at the World Economic Forum in Davos .

The Chancellor shared a panel with the former US Treasury Secretary, Larry Summers, who in 2011 labelled the Coalition’s austerity policy “oxymoronic” and predicted that “it would not work out well”.

Mr Summers said he was “very gratified” by the UK’s surprise recovery over the past year, which has seen the economy grow at its fastest rate since 2010, but he pointed out that America, which followed a more expansionary fiscal policy, had recovered its 2008 output peak several years ago, while the UK was still languishing below that level.

However, the Chancellor countered that Britain had experienced a larger recession than the US in 2008-09 and that it hosted a larger financial system relative to the economy, which meant it had suffered more from the credit market shock.

Mr Summers shot back that “the deeper the valley you’re in the faster you can grow”, implying that the Chancellor’s tax rises and spending cuts in 2010 had prevented the British economy from growing sooner.

He also praised the role played by “our British friends” in co-ordinating a response to the global financial crisis, in a reference to the previous Labour government led by Gordon Brown.

Mr Summers, who was an unsuccessful candidate to take over as head of the US Federal Reserve central bank, has called for wealthy states like Britain to undertake state infrastructure spending in order to counter what he describes as a “secular stagnation” in advanced economies.

But, in response, the Chancellor insisted that there is “no free lunch” when it came to state spending and that an increase would come at the expense of credible fiscal policy and result in a bond market panic, citing eurozone states as an example.

Mr Summers maintained that the crises in Spain, Italy and others had primarily been the result of bad policy decisions in the eurozone.

The Chancellor was asked about the prospect of the UK property market overheating. He replied that the Bank of England’s policy toolkit, which is supposed to enable the central bank to prick bubbles before they form, was “second to none” in the world.

However, Mr Summers warned against “macroprudential complacency” and said that the ability of policymakers to foresee bubbles was doubtful. He said the focus should instead be on building up banks’ capital buffers.

The Chancellor has gone against the advice of his own Independent Commission on Banking and set the minimum capital buffer for banks at 3 per cent of their total assets, rather than the recommended 4 per cent.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies