The rich get richer as pension pots grow

The wealthiest 10 per cent are now 500 times richer than the bottom 10 per cent – and the gap is growing

The wealth gap between the rich and poor has widened dramatically as the well-off have seen their pension funds soar, according to official figures published this week.

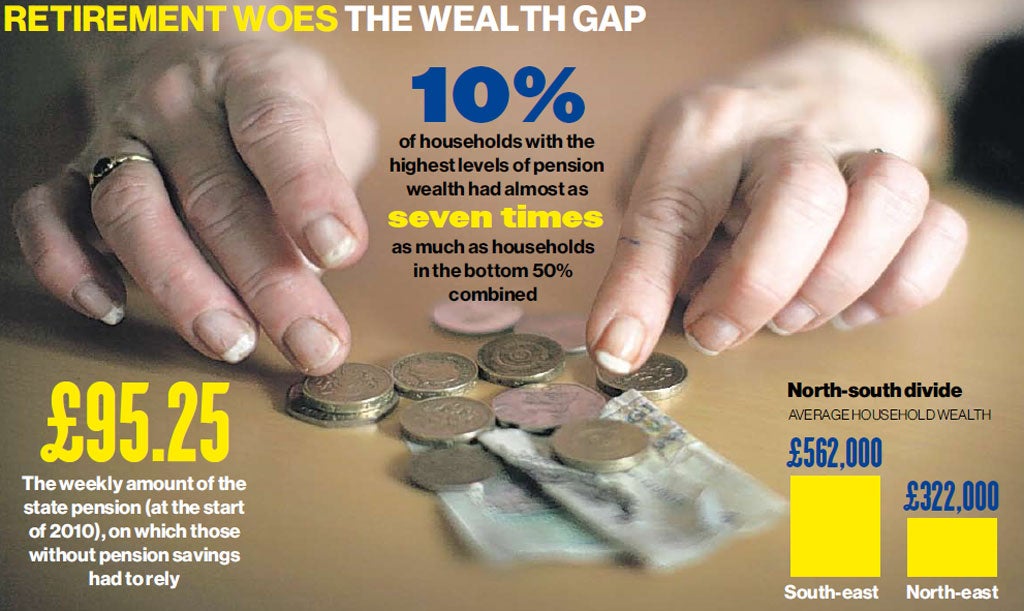

The Office of National Statistics reported that the 10 per cent of households with the highest levels of pension wealth had almost seven times as much as households in the bottom 50 per cent combined.

Meanwhile the richest 10 per cent of Britain's households are more than 500 times wealthier than those in the bottom 10 per cent. Families in the top bracket had a total wealth of £4.5 trillion in 2008/10, the most recent figures available. Those at the other end of the scale only had £8bn.

The figures confirm that the golden generation now retired or close to it has been able to cash in after enjoying unprecedented pension payouts and property growth.

But, alarmingly the figures revealed that the wealth gap is likely to widen in the future as fewer people than ever save adequately for retirement. Two years ago just a third of people contributed to a pension. That figure is likely to have shrunk since then as times have got harder, money tighter, and work harder to find.

Danny Cox, financial adviser at Hargreaves Lansdown, said: "There's a growing wealth gap because generally people are either spenders or savers. The spenders rarely save –often because they can't afford to – and therefore the accumulation of wealth is limited to modest pension contributions and perhaps the rise in value of their home.

"The savers benefit twofold: they spend less than they earn and save the difference; and then the more they save, the more they benefit from the compounding of interest and investment growth over time."

Backing that up, the ONS figures show that the 18 per cent of people who had saved into and cashed in a private pension by 2010 had an average pension wealth of £79,400. Those without pension savings would have had to rely on the state pension –which at the start of 2010 stood at just £95.25 a week, or £4,954 a year. One in four households had no private pension wealth whatsoever.

The figures also revealed a stark contrast between traditional final salary pension schemes and their replacements, the so-called defined contribution schemes, which are linked to how much you've paid in rather than how much you earn.

The average wealth held in final salary schemes which had yet to be cashed in was £93,900. But the average amount in defined contribution pensions was just £16,000.

The Wealth in Great Britain study also looked at the value of people's possessions, homes and finances. It found that while private pension wealth has increased as a proportion of total wealth in recent years, property wealth has actually decreased as a share as the housing market has remained stagnant.

The contributions of financial and physical wealth have remained fairly stable, the report found.

The total wealth of Britain's households reached £10.3trn in 2010, up from £9.1trn two years earlier. Mean average household wealth grew to £418,000 from £373,000.

But the report confirmed the widening north-south divide. Families in the South-east were best off, with an average wealth of £562,000, but those in the North-east were worst off, with a total wealth of £322,000.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies