Julian Knight: Whiplash away! As claims create ever-rising premiums

Insurers need show ministers how they will tackle compensation culture

This week the insurance industry will lay out for the Government exactly how it is tackling the problem of escalating car insurance premiums.

Having been brought to task over referral fees – where insurers sold on accident details to claims companies – the industry will come down hard on our endemic compensation culture.

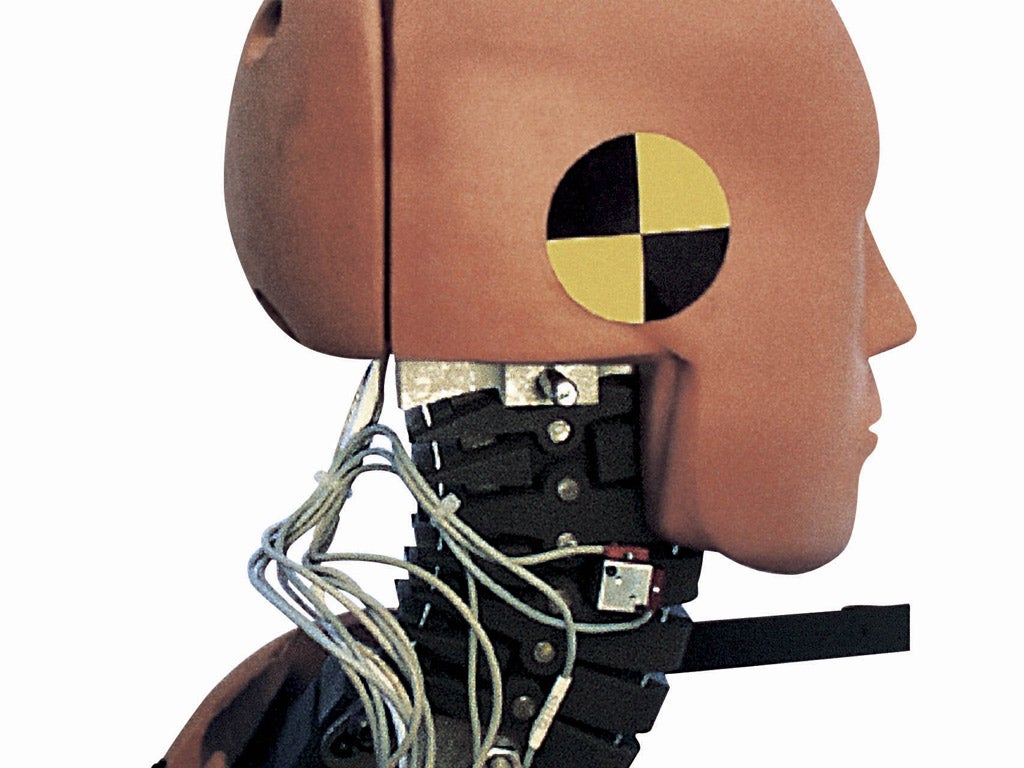

Whiplash, which adds around £90 a year to each premium, is one of the biggest cons going. If you need proof: in the past five years the number of road accidents have fallen, yet whiplash claims have risen by a third. The average cost of a whiplash claim to insurers, from policyholders going through a solicitor, is £12,500, but just £2,500 finds its way to the claimant, the rest is swallowed in fees.

Ending our compensation culture is central to reducing premiums. Making whiplash harder to claim is an obvious step.

The attitude of insurers to younger drivers is less commendable. I know accident figures for young motorists are bad, but without experience they can't improve to become less of a risk. At the moment, all that is happening is ever-higher premiums and a broadening of the age at which a driver is deemed "young". Once, you could expect to see your premiums fall beyond age 21, and then it was 25, now, increasingly, it's 30. The ridiculous cost of premiums for the young encourages fraud.

The industry will tell ministers more about its roll-out of telemetrics (which monitor driving habits to set premiums) and call for a total ban on alcohol for drivers and the end of crammer test courses. This is all sensible stuff, but something needs to be done about pricing now. Perhaps a more flexible approach to building up a no-claims discount quickly, or a change in the treatment of youngsters who are named drivers on their parents' policies. I'd also like to see more transparency on extra policy charges, such as those levied for changing address. It costs pennies to make a change but, too often, the charge runs into pounds.

All in all, I'm not a fan of Government market interference, nor of No 10 summit meetings, but it does look as if we could be moving in the right direction. But the industry still has a long way to go. The final proof will only come at premium renewal time.

Bye bye, Shapps?

Jeremy Hunt's travails have filled me with hope that we could soon be rid of Housing minister Grant Shapps via an enforced reshuffle. The multi-millionaire is as remote from the real world as duck-house building and moat-cleaning MPs of yore.

Last week, on the BBC's Radio 4's Today, Mr Shapps claimed that rents were falling – erm, where exactly? – and prefers to spend his time on empty gestures and promoting policies harking back to Thatcherism, such as revamping Right to Buy.

His opposition to much needed reform of the managing agent/freeholder sector was condemned in a House of Lords debate last week. Baroness Gardner of Parkes pointed out how two million homeowners are exposed to fleecing by practices which in the US would be clear fraud. Meanwhile, the never-ending Office of Fair Trading "investigation" into fees relating to the retirement properties market is leaving many of the most flagrant abuses untouched, according to Bruce Moore, the chief executive of Hanover Housing. It's all very depressing.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies