The devil is in the detail with promises by McDonnell and Javid to boost public spending

Analysis: Specific spending promises have a habit of being undone, writes Sean O'Grady, and there are plenty of difficult challenges ahead

You might not realise it from the heated rhetoric about Joseph Stalin and Donald Trump, but the two main parties are going to take the British economy in a remarkably similar direction – as all the reputable think tanks such as the institute for Fiscal Studies and the Resolution Foundation agree. The British state will, by the middle 2020s, be rather larger than it is today, and the total national debt will little changed from where it stands now.

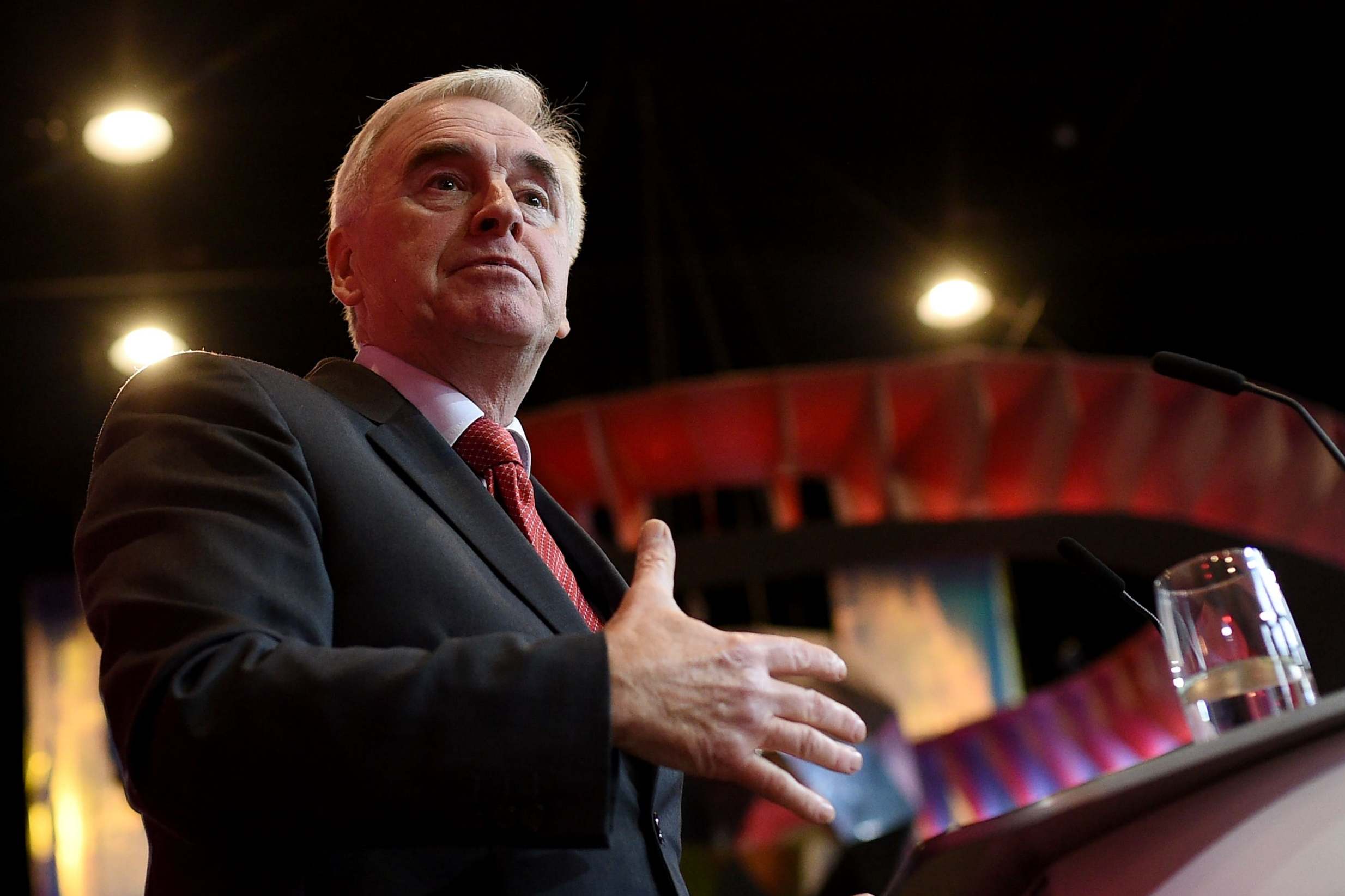

Both parties, for example, will revise the Treasury’s “fiscal rules” to mean that they have more freedom to borrow to invest. The Conservatives propose a new 3 per cent limit of GDP for such projects, against a smaller, vaguer current target. For Labour, shadow chancellor John McDonnell simply says that there will be no rule for borrowing to invest in national infrastructure.

Instead, Labour will operate a new measure which will account for the value of the state’s assets to balance the level of the state’s debt in acquiring and running those assets – “public net worth”. This will be a useful way to account for the cost of its £150bn Social Transformation Fund (over five years, building housing, care homes and upgrading schools and hospitals), the £250bn (over 10 years) Green Transformation Fund and the costs (unknown) of renationalising the Royal Mail, the railways and parts of the water and energy sectors. The £400bn-plus cost of these will be balanced by a £400bn increase in the value of the assets (more or less – depending on how they are valued).

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies